In commercial real estate, the asset manager plays a critical (but often overlooked) role in protecting investor capital and maximizing property performance by executing and managing the business plan to ensure the property cash flows and yields a return for it’s investors.

While property managers handle the day-to-day operations, and manages the tenants, it’s the asset manager who keeps their eyes on the bigger picture (performance and profitability of a property).

They make sure the business plan actually happens, the numbers actually make sense, and the LPs actually get paid—by tracking financial metrics, optimizing NOI (net operating income), and making strategic decisions like when to refinance or sell.

What Does The Asset Manager Actually Do?

| Area | Role |

|---|---|

| 📊 Financial Performance | Track NOI, rent growth, expenses, and ROI |

| 🏘️ Property Oversight | Coordinate with property management, approve budgets |

| 🧾 Reporting | Send investor updates, financials, occupancy reports |

| 💸 Distributions | Manage timing and amounts of payouts to investors |

| 🏦 Debt Management | Track DSCR, refi windows, and lender requirements |

| 🛠️ Capital Projects | Oversee value-add renovations or major repairs |

| 📈 Strategic Planning | Recommend when to refinance, reposition, or sell |

💼 What Is an Asset Management Fee?

It’s a recurring fee the sponsor (you or the GP team) earns for overseeing the investment on behalf of the limited partners (LPs).

💰 How Are Asset Managers Paid?

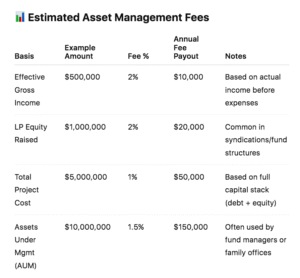

Typical Fee is 1–2%.

✅ The key is knowing what that fee is based on.

There are 3 common ways to calculate it:

1️⃣ % of Effective Gross Income (EGI)

-

Most common for value-add multifamily.

-

Based on actual income before expenses.

Example:

Gross rental income = $500,000

Vacancy = $25,000

EGI = $475,000

2% fee = $9,500/year

Paid monthly or quarterly.

2️⃣ % of Equity Under Management

-

Often used in funds or large syndications.

-

Based on the total equity raised from investors.

Example:

You raised $1,000,000 from LPs

2% = $20,000/year

Usually paid monthly or quarterly, even if the deal’s still stabilizing (means the property is finally making consistent money and the expenses and income are predictable).

3️⃣ % of Total Project Cost or AUM (Assets Under Management)

-

More common with large-scale operators or institutional-style deals.

-

Can be based on total capital stack (equity + debt).

Example:

$5M project cost

2% = $100,000/year

Typically paid out of cash flow or capital reserves.

🔹 Sometimes: Bonus Incentives

-

Profit share or bonus if the property hits performance milestones

-

Could include part of the promote/sponsor split

💡 Pro Tips:

-

The asset management fee is a cost to the deal, meaning it comes out of cash flow before distributions to LPs.

-

LPs want transparency: they’re paying you to protect their money and execute the business plan.

- Always define exactly how the fee is calculated in your operating agreement or PPM (Private Placement Memorandum). This PPM should be drafted by a Syndication Attorney (for commercial deals set up with a syndication structure) or Security Attorney, more specifically one who specializes in Fund Formation or Private Funds.

Got a deal under contract and ready to see if your deal qualifies for funding?

Grab our 5 minute scorecard to see if your deal is funding ready.

DISCLAIMER: This is not real estate, legal, or financial advice. Please contact your preferred attorney or financial adviser for help specific to your needs or issue.